- this menu requires access rights assigned in the User Setup.

- this menu requires access rights assigned in the User Setup.

The Interest Accrual Settings -will set ALL debts with the Account Code of "TAX" as Interest Accruing or set ALL debts, not just "TAX" as NOT interest accruing.

Frequency: This process can be run at anytime, but is normally done only once, after the import of tax debts or the data entry of tax debts and the interest accruable not set.

- this menu requires access rights assigned in the User Setup.

- this menu requires access rights assigned in the User Setup.

- if setting all Account Code "TAX" to Interest Accruing then the Base Amount and Base Interest must be loaded and correct in order to begin calculating monthly interest.

- if setting all Account Code "TAX" to Interest Accruing then the Base Amount and Base Interest must be loaded and correct in order to begin calculating monthly interest.

- LOCAL GOVERNMENTS SHOULD CONSULT WITH THE CLEARINGHOUSE BEFORE EXECUTING THIS FUNCTION!

- LOCAL GOVERNMENTS SHOULD CONSULT WITH THE CLEARINGHOUSE BEFORE EXECUTING THIS FUNCTION!

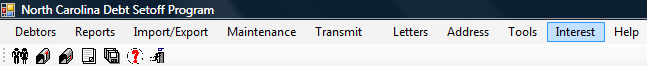

1. From the Main Menu click Interest:

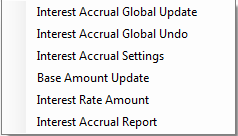

2. The Interest menu options:

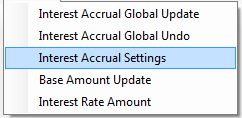

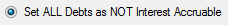

3. Move the mouse over Interest Accrual Settings and click this option:

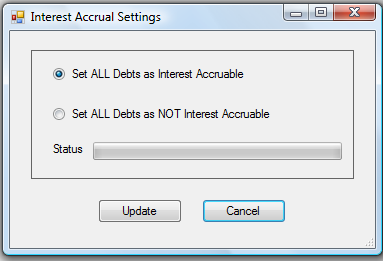

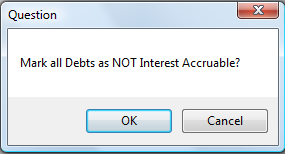

4. A dialog screen appears:

to set Account Code "TAX" debts as interest accruing

to set Account Code "TAX" debts as interest accruing

- Click

to abort and return back to the main menu

- Click

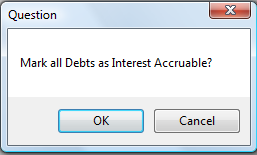

for the following appears:

- The following appears:

- Click

to abort the change and return to the selection screen

- Click

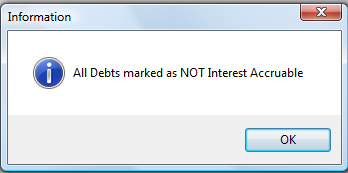

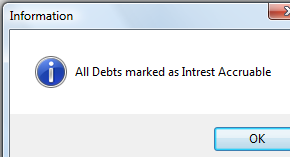

to begin the process and when completed the following appears:

to set all debts as NOT interest accruing

to set all debts as NOT interest accruing to abort and return back to the main menu

to abort and return back to the main menu for the following appears:

for the following appears:

to abort the change and return to the selection screen

to abort the change and return to the selection screen to begin the process and when completed the following appears:

to begin the process and when completed the following appears: